Alphabet’s surge this year shows something clear.

The company builds on real demand. It builds on real cash flow. It builds on strong leadership. While others chase stories, Alphabet keeps compounding.

That is how wealth is created.

A Business Built on Habit and Cash Flow

Mr. Market is finally recognizing something we saw more than two years ago.

Alphabet added about $1.3 trillion in market value since September 2.

That figure is nearly double the combined gain of the rest of the Magnificent 7.

Alphabet gained $1.3 trillion after a ruling cleared the way for its AI growth.

This tells you something powerful about the strength of the business. It is not riding a fad.

It is supported by a river of revenue from billions of loyal users. Every search. Every map request. Every email. Each interaction adds to a business model that has become one of the most profitable in history.

Alphabet’s momentum accelerated after a federal antitrust judge ruled on September 2 that its position in search no longer posed the same competitive threat in the age of AI.

Once that cloud lifted, the company was free to focus on growth rather than litigation. As the stock hovers around a $4 trillion valuation, investors see that Alphabet has far more going for it than the fear stories that captured headlines.

For nearly two years, many predicted that ChatGPT would weaken Google’s moat. Some claimed conversational search would reduce Alphabet’s margins by as much as 14%.

Yet the opposite happened. Users continued searching on Google. Traffic rose. Monetization held firm. People rarely change a habit that serves them well, and billions rely on Google every day.

Gemini 3 Proves Alphabet’s Leadership in AI

A few weeks ago strengthened the story further. On November 18, Alphabet introduced its Gemini 3 model, which outperformed its rival on key benchmarks.

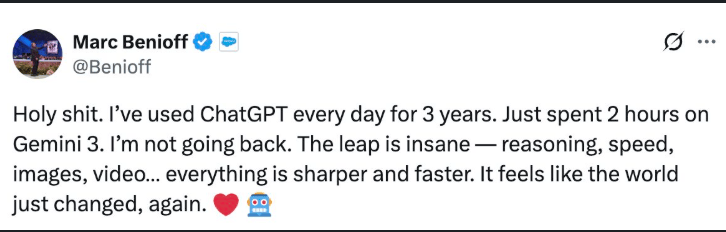

Less than a week later, Marc Benioff, the CEO of Salesforce, tested Gemini 3 and tweeted he is not going back.

That result did not come from luck. It came from three long-term advantages that fit hand in glove with our American Prosperity approach.

Research depth. Alphabet owns DeepMind, one of the world’s most advanced AI research groups. More than a decade of research now shows its worth.

Control of its computing stack. Alphabet trains its models on chips it designs. Rivals depend on whatever supply they get from Nvidia. Control leads to speed, and speed matters.

Financial strength. Over the past five years, Alphabet generated about $330 billion in free cash flow. That level of cash allows the company to invest for the long term. It can support projects that may not show revenue for years.

Most companies cannot do that. Alphabet can because the engine behind the business keeps producing cash.

Free cash flow is one of the closest things to freedom for any business.

It gives Alphabet the ability to build rather than react. It gives Alphabet the ability to think in decades rather than months. It gives Alphabet the flexibility to shape the future of AI instead of watching from the sidelines.

This financial strength is one of the reasons Warren Buffett’s Berkshire made a $4.3 billion investment in Alphabet in the third quarter of this year.

Warren Buffett rarely invests in technology unless the business model is clear and the competitive advantage is strong.

Berkshire’s position speaks loudly. They saw what we saw. A company with a competitive moat, a river of cash, and a long runway for growth.

Why Alphabet Fits Our American Prosperity Approach

Our members acted even earlier.

Alphabet (GOOGL) has been in our American Prosperity portfolio since April 2023.

Since then, the stock has climbed about 200%.

That gain came from buying a great business when the crowd was distracted. Many were worried that AI would take Alphabet down. We focused on cash flow, habits, leadership, and long-term tailwinds.

Alphabet now generates nearly 20% of its revenue from cloud computing. That reduces reliance on advertising cycles. Gemini 3 may help Alphabet win real share in enterprise software.

The company’s custom chips could become another revenue stream as AI competitors search for faster and cheaper hardware. Alphabet is not shrinking. It is expanding into new markets with confidence backed by financial muscle.

Alphabet proves again that America remains the greatest place on earth for innovation and opportunity. Our economy rewards ingenuity. It rewards persistence. It rewards investors who focus on value instead of noise.

We saw Alphabet’s strength early. We stayed patient. We benefited from that patience. And from where I sit, the next chapter looks even brighter.

America keeps building. Alphabet keeps growing. The opportunities ahead look as promising as ever.

Not a subscriber to the American Prosperity Report yet? Click here to join now — risk-free with our 30-day money-back guarantee.

If you have questions, you can send them to me at [email protected].

And follow me on X here for daily updates.

Regards,

Charles Mizrahi

Prosperity Insider