“Once upon a time…”

When I was growing up, my bedtime ritual included a fairy tale that always started with the same words and always concluded with the familiar, satisfying phrase that marked the end of the story … and let me know it was time to go to sleep!

You remember those famous closing words, don’t you? I imagine a smile already coming to your face as they form in your mind: “And they lived happily ever after.”

As a child of the optimistic 1950s, I dreamed that life might be like that. No matter what obstacles, dangers and perils might come my way, I would live happily ever after.

I was a teenager in the 1960s, went to college and got married in the 1970s. I raised young children in the 1980s and teenagers in the 1990s.

In the ’90s, I also embarked on a political path that would take me to almost 11 years in the Arkansas Governor’s Mansion and two runs for the White House.

During the decade beginning in 2010, I really did hit the jackpot with the arrival of the six cutest and most adorable grandchildren on earth.

My journey so far has convinced me that while we all may start with certain expectations, life does not always lead to living happily ever after. Life can sometimes be hard — very hard.

In 2003, my story could have ended and not with the happily ever after I would have wanted.

I had been experiencing chest pain and shortness of breath but stubbornly said I didn’t have time to go get checked out. Then, I woke up early one March morning with a numb and tingly arm. I had to see a doctor.

The doctor immediately diagnosed me with diabetes. I was devasted and angry with myself. I hadn’t done anything to prevent it.

Like most kids growing up in the South, I was raised to believe the preferred way of cooking anything is to first batter it in cornmeal or flour, then fry the ever-loving nutrition out of it in a pan of hot gurgling grease. As Baptists, we also consumed large portions of all that fried food.

So fast forward to me a 5’11, nearly 280 pounds, a diabetes diagnosis and facing the devasting reality of potentially not seeing my grandkids grow up…

It was time to make some changes. And I did. By March 2024, I’d lost 105 pounds and reversed all the symptoms of my diabetes.

Before and After: A picture of me in the 90s compared to today.

I take health care very seriously. So, when Charles shared this month’s American Prosperity Report recommendation with me, it immediately caught my attention.

Not only is it our goal to help you achieve prosperity through health and wealth … but Charles always says if an investment really speaks to you, that’s the one you should add to your buy list.

And this one speaks to me. As people like us age, health care spending in the U.S. will continue to soar.

It’s projected to reach $12 trillion by 2040 (from just $4.5 trillion today). When that happens, health care will account for more than 25% of America’s GDP!

Another segment driving the business’ growth is focused on medications such as GLP-1s, which are essential for treating chronic conditions like diabetes — showing its proactive approach to tackling affordability issues in the pharmacy industry.

And there’s one company that will ride this tsunami trend…

Keep reading for all the details…

— Mike Huckabee

Turning America’s Health Care Crisis into Profits: Why We Like Cigna Even More

The U.S. spends more on health care than any other country, with current spending at around $4.5 trillion.

Over 85% of health care costs come from treating chronic conditions, and 1 in 5 adults in the U.S. live with a mental health illness. That adds up to a high financial burden on the health care system.

This is a big opportunity for investors to turn America’s health care tsunami into gains.

The company I recommend is Cigna Corporation (CI) — the fourth-largest health insurance company in the U.S.

I initially recommended it in February 2023 (up 10%), and I have to say, I like it even better today. You see, while the worth of the underlying business has increased, the stock price has hardly budged … making it an even better buy now.

Cigna provides health insurance to 186 million people across the U.S. The company is strong enough to handle inflation and recession without much impact.

Here’s a snapshot of why we like it:

Cigna highlights three pillars for delivering better health:

Proven results: 10+ year track record and 13%+ earnings per share (EPS) growth.

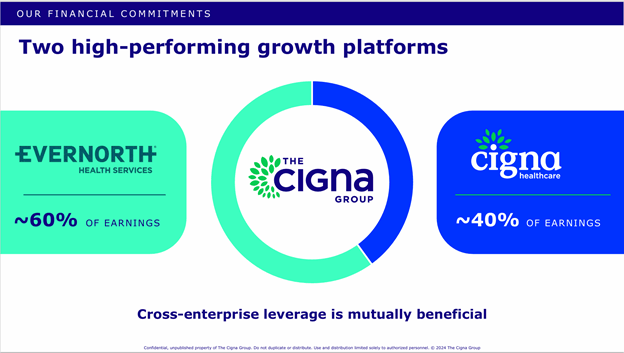

Value creation across Evernorth Health Services and Cigna Healthcare.

A future-focused strategy with a 10% to 14% EPS growth target.

These pillars show Cigna’s dedication to making a difference now and staying strong in health care for the long term.

Cigna’s Growth Play: Tapping into the U.S. Employer Market, Specialty Drugs and Biosimilars

Cigna stands out from other health insurers with its focus on commercial health insurance and pharmacy services.

When we added Cigna in 2023, its revenue was $180 billion, and its EPS was $23. Over the past two years, Cigna has been firing on all cylinders.

Since our original recommendation, revenue guidance for 2024 is at least $235 billion, an increase of 30%. EPS has soared to $28, a gain of 22%.

The company has also repurchased 26 million shares, or a decrease of 9% of shares outstanding. Overall, since 2019, the company has repurchased 25% of its shares.

How’d they do it?

By providing health insurance under Cigna Healthcare and their pharmacy business under Evernorth Health Services.

Cigna Healthcare ($51 billion in revenue, which accounted for 40% of earnings).

Cigna has focused on serving employers and private health plans, a strategy that has proven more profitable than targeting Medicare and Medicaid, which are the primary focus of UnitedHealth Group (also in our portfolio) and Elevance Health.

The top three reasons Cigna’s focus on commercial insurance are:

Higher Premiums and Margins: Commercial plans, funded by employers and employees, generally have higher premiums and allow for better margins than government-funded Medicare and Medicaid, which have lower, fixed reimbursement rates.

Flexibility in Plan Design and Pricing: Cigna has greater freedom to tailor commercial plans to employer needs and set pricing based on risk, unlike government programs, which have strict regulations and limited flexibility.

Lower-Risk, Healthier Population: Commercial insurance often covers younger, healthier employees who typically need fewer health care services. Medicare and Medicaid serve older adults or lower-income individuals with greater health care needs, increasing costs and reducing profitability.

Cigna’s growth outlook spans three major health care markets, each with strong potential for expansion. Here’s what they anticipate in terms of future growth…

1. The U.S. Employer Market is huge, valued at about $1 trillion. Cigna expects this market to grow by 4% to 6% and aims to increase its own share by up to 2%. Over the long term, Cigna hopes to grow its income from this market by 6% to 8% each year.

2. The Individual and Family Plans Market is worth about $150 billion. It’s growing quickly, with expected growth of 10% to 15%.

3. The International Health Market is worth about $200 billion. It’s expected to grow by 8% to 10% each year.

Each market offers different growth rates, but collectively, they provide Cigna with opportunities to expand its revenue and profits.

Cigna expects its overall profits from these markets to grow by about 7% to 10% per year over the long term.

Evernorth Health Services ($153 billion in revenue, which accounted for 60% of earnings).

Evernorth’s pharmacy services are broken down between Accredo and Express Scripts.

Accredo dispenses specialty drugs for complex and rare diseases that require frequent dosing and intensive monitoring, such as Leukemia, Melanoma and hereditary angioedema.

Through a network of 600 nurses and 15 centers, it serves over 600,000 patients. Accredo has a 25% market share in the specialty pharmacy industry.

The specialty healthcare market, valued at around $400 billion, is larger and growing faster than the individual Medicare Advantage market, which is approximately $375 billion.

Evernorth Health Services aims to grow at a rate that outpaces the overall specialty market by reducing patient costs.

The specialty market has strong growth potential, with an expected secular growth rate of 7% to 9%. This translates to a projected long-term adjusted income growth outlook of 8% to 11% annually for the specialty segment.

Cigna is also well-positioned to benefit from the rising demand for biosimilars.

A biosimilar is a highly similar version of a biologic drug. Biologics are complex drugs made from living organisms, so biosimilars aren’t exact copies but are designed to be “similar enough” to the original biologic in terms of safety, effectiveness and quality. They are also more affordable.

Their investment in an interchangeable biosimilar for Humira is a great example of how they plan to lower costs and improve patient access.

By 2030, biosimilars and generics are expected to launch for nearly half of the top 25 specialty drugs in the U.S., opening up significant market competition.

This shift will impact approximately $100 billion in annual specialty drug spending, excluding Humira, creating a substantial growth opportunity for biosimilars.

Express Scripts is a pharmacy benefit manager (PBM). A PBM manages drug benefits for customers, filling prescriptions and completing the claims that go with them. The PBM dispenses approximately 1.6 billion prescriptions annually to around 120 million customers.

The pharmacy benefit services market is large and continues to grow. The total addressable market is about $450 billion.

PBMs are generally sticky businesses … customers stay for long periods of time. For example, Express Scripts has a 95%+ customer retention rate.

Customers don’t want to deal with the headache of switching to a new PBM, especially when Express Scripts, as an industry leader, has negotiating leverage to get attractive drug prices for its customers.

One of Cigna’s key strengths is managing the cost of medications. Through innovative programs like EnCircleRx, Cigna works to make prescriptions more affordable.

EnCircleRx will guarantee its clients that it will limit annual increases in GLP-1 drug costs to 15%. The company aims to achieve this through various measures, including helping people with obesity and diabetes get lifestyle modification and coaching support.

That will benefit the 38 million Americans facing diabetes and help lower costs for them and their employers.

When combining secular market growth with share gains, Evernorth is forecasting specialty earnings growth of 8% to 11% in the long term.

Management also expects Express Scripts to continue its steady growth of 2% to 4%. Overall, Evernorth is expected to grow 5% to 8% per year.

Cigna’s focus on cost management, specialty care and new drug solutions makes its Evernorth Health services a key growth area, helping the company strengthen its position in the healthcare industry.

And it has the right person in charge to continue pushing for higher growth ahead.

The Stamina Behind Cigna’s 12X Revenue Growth

Cigna CEO David Cordani is an avid Triathlete … which tells you everything you need to know about his sense of perseverance and dedication.

And that’s why I almost fell off my chair when I read that Cordani has competed in more than 125 triathlons.

Triathlons require unparalleled amounts of stamina, discipline and a long-term outlook. Those are the traits that also make for a great CEO, and the results show it…

Since he became CEO in 2009, Cigna’s revenue is up nearly 12X and earnings per share have soared by nearly 7X.

So far in 2024, Cigna has repurchased 14.7 million shares of common stock for approximately $5 billion.

A Merger That Could Reshape Health Care — And Boost Shareholder Value

Cigna and Humana are talking about merging — again.

They tried it last year, but it didn’t pan out. This time, though, we think it could be a winner and drive some solid value for shareholders.

Cigna and Humana are each in different lanes within health care.

Cigna is the go-to for employer health insurance plans, while Humana’s bread and butter is with government programs like Medicare Advantage. Putting them together is like connecting two puzzle pieces that fit just right — each brings something valuable the other doesn’t have.

The timing? Let’s just say it’s strategic.

Humana’s stock has been hit hard this year — almost cut in half. They’ve been struggling with higher-than-expected medical costs, a decrease in government payments, and drops in their Medicare ratings.

Essentially, they’re on sale, and this might be the perfect moment for Cigna to swoop in.

Now, here’s the savvy part: Cigna is already in the process of offloading its Medicare Advantage business. Selling that piece could make the merger easier because it would help ease concerns that the combined company might have too much market power in certain areas.

The one hurdle? Regulators might be uneasy about how much control the new company would have over pharmacy benefits management, the service that handles prescription drug programs.

But overall, if they can pull this off, it could be a big win for both companies and shareholders alike.

Why Cigna’s Capital-Light Model and $60 Billion Cash Flow Target Set It Apart

Cigna is on target to deliver more than $28 earnings per share by the end of 2024.

Building on their 13% average annual EPS over the past decade … they should continue to deliver EPS growth of a minimum of 10% to 14% per year.

They project to generate cash flow over the next five years of around $60 billion.

They are also focused on returning cash to shareholders via dividends and share repurchases … all with a capital-light model.

This means that very little money is needed for capital expenditures to grow the business.

Now you can see why Cigna is a solid business.

Here’s how Cigna stacks up to our Alpha-4 Approach…

Alpha-4 Approach

Alpha Market: Health insurance is a complicated business with a high barrier to entry. Cigna is one of the leaders in an oligopoly industry.

Alpha Leadership: Under CEO David Cordani’s strong leadership since 2009, Cigna’s revenue is up 12X, and earnings per share have soared by 7X.

Alpha Money: Cigna projects to generate cash flow over the next five years of around $60 billion.

Alpha Price: With the stock trading around $315 per share, we have a great opportunity to buy Cigna today for a great price.

Here’s how we see the company’s valuation right now.

Cigna’s stock is currently trading around $315 per share at a multiple of 12 times earnings per share of around $27.

Based on our research, and factoring in a margin of safety, Cigna should conservatively be able to grow earnings per share by 12% annually over the next five years.

Based on that growth rate, earnings per share would be around $46 in 2029.

Based on the company’s growth trajectory, applying a 13X multiple and adding in dividends should result in a share price of around $625 per share or a 100% return.

Action to Take: Buy Cigna Corp. (CI) up to $360 per share.

Portfolio Update: Raising Our Buy-Up-To-Price

Even a great business that is riding a mega trend and has a rockstar CEO can be a mediocre investment if bought at a high price. That’s why we have a buy-up-to-price.

As the underlying worth of the business grows, so too does the price we can pay for the stock.

Due to rapid growth of the underlying worth of the business, we raised the buy-up-to-price for Taiwan Semiconductor (TSM) from $120 to $165 per share last week.

You’ll see this change reflected in your model portfolio.

If you have any questions, please send them my way at [email protected].

And follow me on X here for daily updates like this one about not letting short-term noise scare you out of investing…

Regards,

Charles Mizrahi

Founder, Alpha Investor

[portfolio_tracker template=”table-no-graph-CMZ” id=”13391″ name=”The American Prosperity Report”]