For the last few years, I warned that the Green Energy revolution was built on belief, not economics.

I had experts on my podcast walk through why the energy transition narrative ignored basic economics.

It was sold as destiny. Buy electric vehicles. Build massive battery plants. Pour capital into capacity first and trust that demand will follow.

Governments subsidized. Corporations complied. Investors cheered.

But markets do not run on belief. They run on cash flow, incentives, and behavior. And now the gap between the story and reality is impossible to ignore.

This week, the Financial Times reported a quiet but telling shift.

Battery manufacturers across North America are abandoning electric vehicle production plans and pivoting toward energy storage systems. Factories designed to power millions of EVs are being retooled to serve data centers instead.

Not because executives changed their values. Because demand changed.

According to industry data cited in the article, battery makers have cancelled enough EV capacity to produce roughly two million electric cars.

Ten plants are now being converted to produce batteries designed for stationary energy storage. Seven of those plants will primarily serve the storage market.

This is not a marginal adjustment. It is a reversal.

The electric vehicle thesis depended on a fragile chain. Subsidies would lower prices. Mandates would force adoption. Consumers would follow. That chain broke.

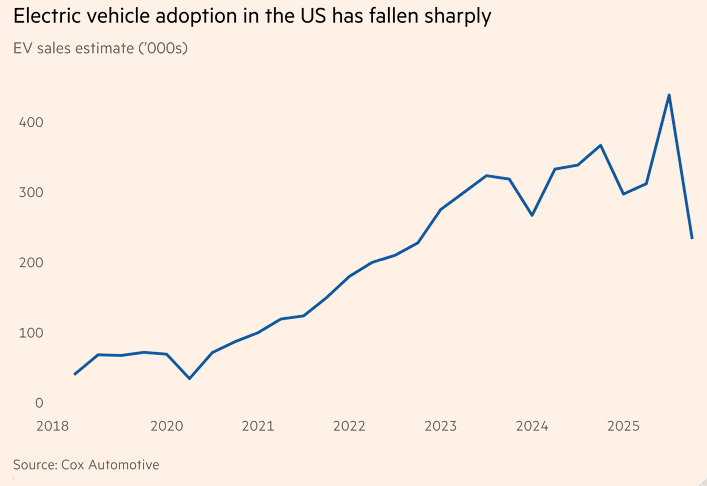

EVs still account for a small share of U.S. auto sales. Growth has slowed. Margins have narrowed. Government support is being rolled back.

Capital is responding the only way it ever does. By moving.

Source: Financial Times. Data from Cox Automotive

Manufacturers are not scrapping their factories. They are repurposing them. That alone tells you something important. The problem was never batteries. It was where they were supposed to go.

Capital Always Finds Real Demand

The new destination is not transportation. It is power reliability.

Artificial intelligence data centers require uninterrupted electricity. Not occasional electricity. Not weather-dependent electricity.

They need stable voltage, instant backup, and redundancy at scale. That makes energy storage essential.

This is where the green fantasy runs into physics.

Wind and solar do not produce power on demand. Storage is required to smooth their output.

But the fastest-growing need for storage today has little to do with climate goals. It has everything to do with AI infrastructure.

That is why companies are pivoting.

Ford is modifying a battery plant in Kentucky to serve domestic energy storage demand.

General Motors has publicly stated it is considering producing its own storage batteries.

Stellantis and its partner Samsung SDI are converting lines at their Indiana plant away from EVs and toward storage cells.

This opens the door for Detroit automakers to become suppliers to Big Tech data center builders. That was never part of the original green narrative. It is now the most rational outcome.

Even Tesla offers a clear signal.

While its electric vehicle revenue declined last year, its energy generation and storage business surged. Storage revenue reached $12.8 billion, up sharply from just $2.8 billion a few years earlier. EV revenue moved in the opposite direction.

The market is speaking.

Forecasts are being revised down across the board. Analysts at BloombergNEF recently slashed their estimate for EVs share of global car sales in 2030 from nearly half to roughly one quarter. EVs currently represent only about 8% of new U.S. car sales.

Those numbers matter. They explain why capital is retreating.

European automakers are paying the price for believing too deeply. Stellantis recently sold its stake in a battery plant near Detroit for a symbolic sum after writing down tens of billions tied to its EV expansion. Nearly a billion dollars invested in that facility is effectively gone.

That is not a failure of innovation. It is a failure of assumptions.

At the same time, energy storage demand is rising for reasons rooted in economics. Data centers are being built at a rapid pace across the United States. Power consumption is climbing. Reliability is non-negotiable.

This is why storage matters now.

When Belief Meets Economics

At American Prosperity, we positioned our portfolio early for this shift by focusing on businesses tied to power reliability, infrastructure, and real demand rather than policy-driven adoption stories.

That is why our exposure has favored companies supplying the backbone of AI and data center growth, where cash flow follows necessity, not mandates.

Even with generous production credits still in place for battery manufacturing, economics remain tight.

U.S.-produced storage batteries struggle to match Chinese imports on cost and performance. Tariffs and subsidies narrow the gap but do not eliminate it. Margins are under pressure. Competition is intense.

That is exactly why this shift is meaningful.

When companies pivot toward lower margin but real demand, it signals the end of fantasy and the return of discipline.

Energy storage tied to AI infrastructure supports productivity and growth. It supports American technological leadership. It supports cash flow.

The Green Energy revolution promised transformation without tradeoffs. The market has rejected that premise. What remains is adaptation.

Capital is not ideological. It does not care about slogans. It moves toward what works.

I warned that belief would eventually meet economics. We are now watching that moment play out.

Not a subscriber to the American Prosperity Report yet? Click here to join now — risk-free with our 30-day money-back guarantee.

If you have questions, you can send them to me at [email protected].

And follow me on X here for updates.

Regards,

Charles Mizrahi

Prosperity Insider