Over the past two years, I’ve been sharing with you one simple truth: the AI revolution isn’t powered by headlines. It’s powered by concrete, steel, wiring, transformers, and an enormous amount of electricity.

Every time an AI model becomes smarter, it requires more computing power. And every jump in computing requires more data centers, more power, and more infrastructure.

That’s why we’ve been bullish on the companies building the backbone of this new economy.

But a recent Financial Times report highlights just how intense this build-out has become, and why our long-term thesis has even more runway ahead.

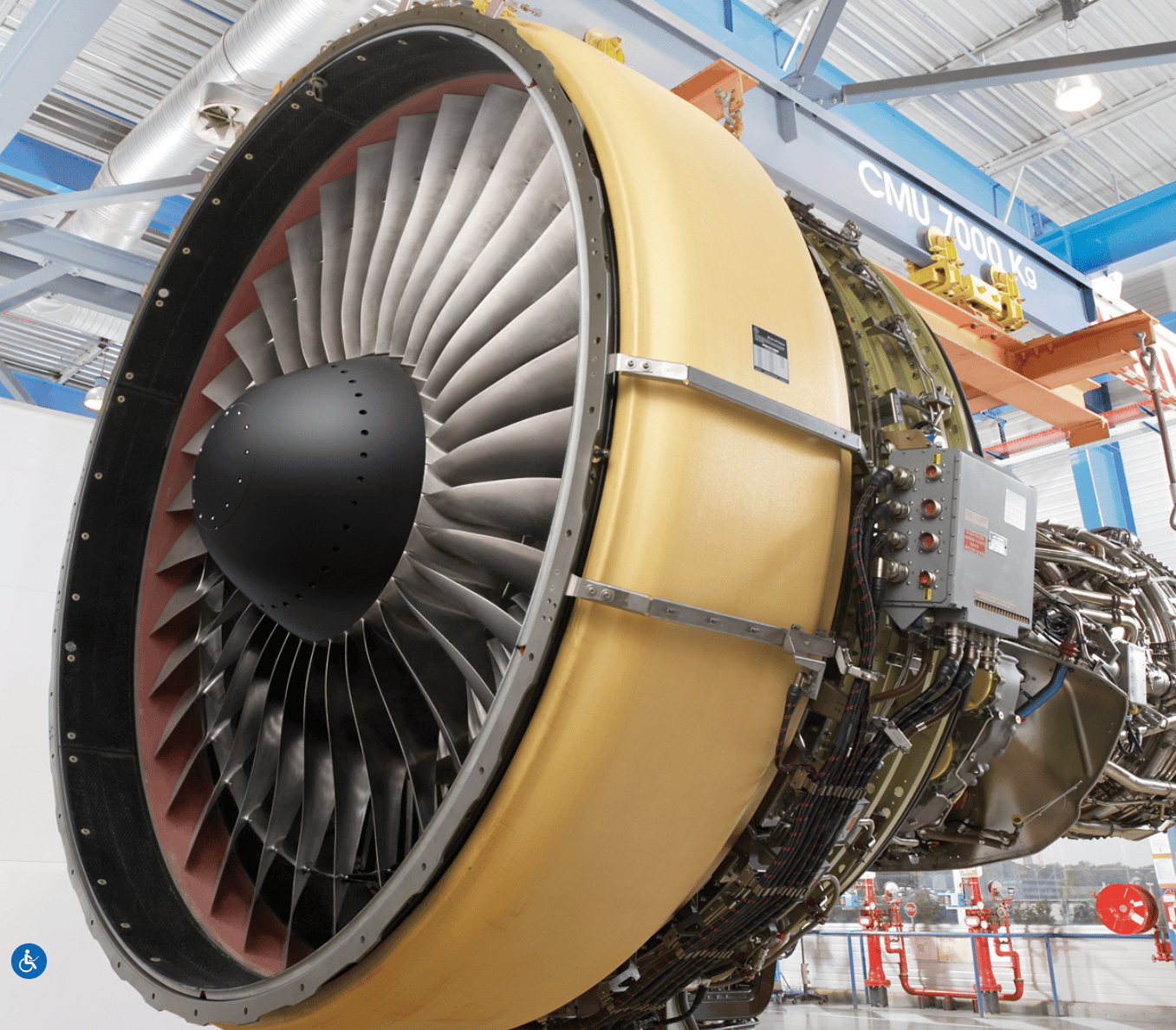

Data-center developers are now turning to a surprising source of energy while they wait for permanent, grid-scale power: aircraft engines.

Yes, the same jet engines that power Boeing 747s.

Source: GE Aerospace

Repurposed aircraft engines help data centers power AI demand.

When Demand Moves Faster Than the Grid

Real Talk: Data centers are facing wait times of up to seven years to connect to the electrical grid.

Utilities simply can’t keep up with the load.

Big Tech has already announced close to $400 billion in AI-related capex, and the grid was never built for that.

So developers are doing whatever it takes to get power today, because in AI, waiting seven years is the same as being left behind forever.

That’s why companies like GE Vernova, ProEnergy, Boom Supersonic, and Cummins are seeing demand surge for aeroderivative turbines, jet engines adapted for stationary power generation, and diesel or gas generators.

These systems aren’t as efficient as large gas turbines or renewables. They’re not cheaper. They’re not cleaner.

But they’re available now — and “now” is the most valuable commodity in the AI arms race.

GE Vernova alone is supplying nearly 1 gigawatt of jet-engine power for the new Stargate data center serving OpenAI, Oracle, and SoftBank.

ProEnergy has sold over 1GW of its 50-megawatt turbines, some using CF6-80C2 engine cores from retired 747s.

And Cummins? The company has sold 39 gigawatts of generator capacity to data centers and nearly doubled its capacity this year.

When you see enormous demand rippling out into industries that only yesterday seemed miles away from AI, aviation, industrial engines, and diesel machinery, you know you’re witnessing a real, durable mega trend.

What This Means for Investors

This entire story reinforces a point I’ve been hammering for more than a year: The AI boom isn’t about chatbots, it’s about infrastructure.

Power. Cooling. Buildings. Servers. Networking. Land. Transformers. Turbines. Pipes. Steel. Cement.

Everything the digital world needs, the physical world must build first.

And history teaches us something important: in every industrial revolution, the companies supplying the picks and shovels often create the most reliable long-term returns.

During the railroad boom, it wasn’t just the railroads — it was the steelmakers.

During the automotive boom, it wasn’t just the automakers — it was the suppliers and parts manufacturers.

During the PC revolution, it wasn’t just the computer companies; it was Intel, Microsoft, and the companies powering the ecosystem.

Today, AI infrastructure is the same story.

Short-Term Noise, Long-Term Clarity

Some analysts warn that this scramble for power won’t last forever, and they’re right.

Hyperscalers will eventually slow capital spending. Grid upgrades will catch up. More efficient turbines and renewables will come online.

But that’s missing the real takeaway.

Even if the pace slows, the direction doesn’t change.

AI models are getting larger. Training cycles are getting more power-hungry. The demand for computing power, and the physical infrastructure behind it, keeps marching upward.

And while developers may rely on jet engines and diesel generators today, they’ll eventually transition to bigger, permanent power solutions tomorrow. That means more long-term demand for grid upgrades, gas turbines, transmission build-out, and renewable integration.

Investors who understand this don’t chase the flashiest AI headline. They follow the businesses that are building the foundation.

Why We Remain Bullish

When the world’s most advanced data centers are scavenging aircraft engines to keep up with AI workloads, you’re not in a bubble. You’re in an industrial build-out on a scale we haven’t seen in decades.

The companies providing power, cooling, servers, semiconductors, and infrastructure aren’t riding a fad. They’re supplying the tools that make the entire AI economy possible.

And as I’ve said for more than 40 years, the stock price eventually follows the business, not the other way around.

The businesses supplying AI infrastructure are growing, expanding, and investing because demand keeps rising. That’s why we’ve stayed bullish on them. And stories like this prove we’re still early.

AI is not slowing down.

And neither is the need for the companies powering it.

Not a subscriber to the American Prosperity Report yet? Click here to join now — risk-free with our 30-day money-back guarantee.

If you have questions, you can send them to me at [email protected].

And follow me on X here for daily updates.

Regards,

Charles Mizrahi

Prosperity Insider