I remember the first time I spoke publicly.

It was 1976, and I was in my high school freshman English class.

Mrs. Goldfarb told every student that they’d need to tell an anecdote in front of the class.

It only had to be a minute long, but I started sweating.

“Charles, Esther, Kenny and Susan … you’re up next Friday.”

My stomach started doing backflips as soon as I heard my name.

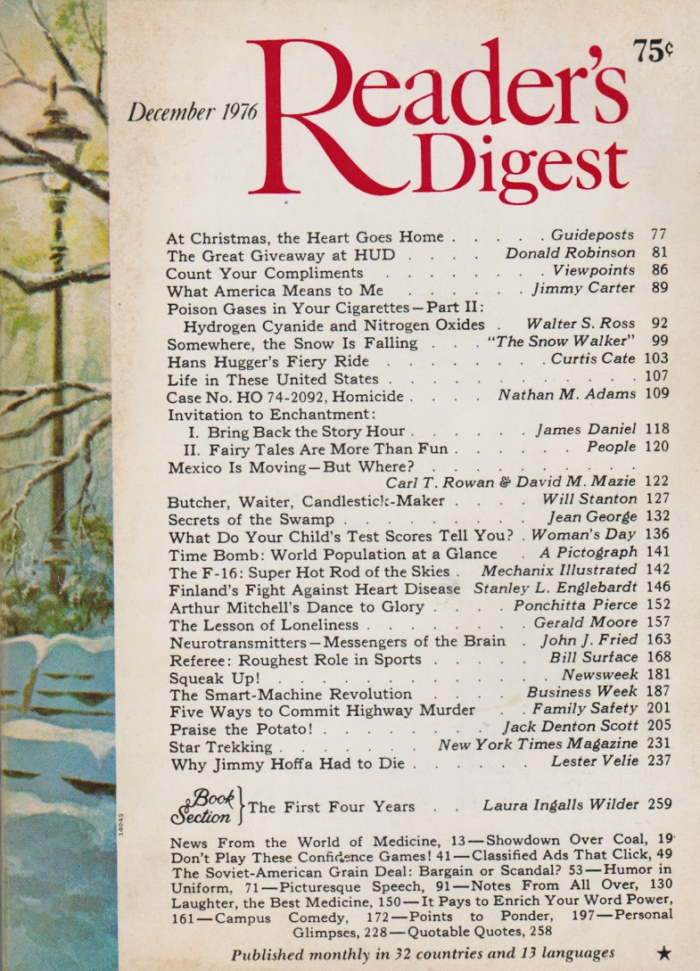

Over the next week, I looked through every Reader’s Digest we had in the house.

For many years, Reader’s Digest was the bestselling consumer magazine in the U.S.

I finally found one that was short, a bit funny and would quickly put me out of my misery.

The next Friday, I was up first.

My knees were shaking as I stood in front of the class.

I figured that I must be doing okay since I hadn’t fainted yet.

I delivered the anecdote…

Roquefort Cheese

The class laughed, and Mrs. Goldfarb was pleased.

I also discovered that I really enjoy public speaking.

Years later, I joined Toastmasters International and was a member for more than 20 years.

I won several district speaking contests, was president of my club and founded one as well.

And like your first love and first kiss, there are some things you never forget.

I clearly remember the anecdote I delivered more than 45 years ago.

It goes like this…

A man walks into a gourmet food store to buy cheese.

He lifts the glass lid off an expensive French cheese.

And then takes a big breath and inhales the aroma.

Pleased, he tells the owner, “I’d like 25 cents’ worth, please.”

The owner responds, “Mister, you just got it.”

Decades later, I told my kids about my first public speaking experience.

They had no idea what the anecdote was about.

To really appreciate it, you need to know the context of when it was written.

At that time, inflation was raging…

The Great Inflation

Inflation was front of mind everywhere you went.

President Ford was wearing WIN (Whip Inflation Now) buttons.

And us kids knew about it close-up.

Our parents complained about the high cost of everything.

We sat with them in long gas lines that stretched for miles.

And our $1-a-week allowance bought less and less each week at the candy store.

You couldn’t live in the U.S. in the 1970s and ’80s without being impacted by inflation.

In 1980, Warren Buffett called inflation “a gigantic corporate tapeworm.”

It consumes corporate and personal savings in the same way…

It sucks out the purchasing power of dollars.

Fool Me Once…

I really thought politicians and the Federal Reserve learned their lesson.

And for a long time, it looked like they did.

From the early 1980s through the end of 2020, inflation was not a factor.

It averaged around 2.8% per year over that time.

But the wheels started to fall off the cart in early 2021.

That’s when Washington voted on a much unneeded $1.9 trillion stimulus package.

It was one of the largest federal aid packages since the Great Depression.

This was on top of the Biden administration’s war on fossil fuels.

The table was set for inflation to rear its ugly head.

Too many dollars were chasing limited supply, and prices started to surge.

Over the past 12 months…

Gas prices are up 60%, airfare is higher by 34%, and household energy costs are 22% higher.

And yesterday, the Consumer Price Index’s increase for the past 12 months was 9.1%.

In other words: If you have $100,000, you just lost $9,100.

This was the fastest pace inflation has risen since November 1981 — a 41-year high.

So, now what?

Melting Ice Cube

The stock market has been taking each inflation report like a punch to the face.

Stocks continue to fall, and many investors are throwing in the towel.

But here’s why you shouldn’t…

When you sell your stocks (pieces of a business), what are you doing with your cash?

If you’re leaving it in your brokerage account and making less than 1%, you’re in big trouble.

Just check out this chart…

Inflation is sucking out the purchasing power of your dollars.

So, letting your cash just sit and earn a low interest rate is the worst thing you could do now.

Instead, the best place to put your dollars to work is in stocks.

Even with short-term downturns, stocks move higher over time.

Nothing else comes close. The numbers don’t lie.

That’s why my message to you today is: Don’t give in to your instincts and sell your stocks.

Owning a piece of a business is how you should respond to inflation.

Alpha Investors buy great businesses while they’re trading at bargain prices — like they are right now — and hold them for the long term.

And that’s exactly what you need to be doing right now.

If you aren’t yet, find out how to join the Alpha Investor family right here.

Regards,

Founder, Alpha Investor